By: Alex Toh, SC Ventures | 16 June 2020

(Opinions expressed are solely my own and do not express the views or opinions of my employer)

Being in the startup scene, you tend to be (or after a while become) optimistic as you’re surrounded by passionate people building their dreams. On the VC side, you can do as much due diligence, research and scenario planning as possible, but every single investment is always still a leap of faith. Calculated, but still risky nonetheless.

Too many unknown unknowns exist, and as we’ve seen in the past months, the emergence of a new coronavirus has effectively changed everything. We’ve seen how the pandemic has overturned the airline, tourism, retail, F&B and many other industries. However, there are also others that have ‘benefited’ from the situation; e-commerce, delivery, online payments, telecommuting, gaming, social media, heck, even toilet paper manufacturing. Multiple articles have already covered these sectors.

In trying to keep up with the mood of positivity and optimism, I’d like to focus on the underlying changes and positive knock-on effects that this situation has created and share some observations and thoughts.

Digitisation becomes a thing.

In 1955, John Hancock (now Manulife) digitized 600mb of life insurance policies. A 2018 survey findings revealed 70% of companies have a digital strategy (or are working on one). This buzzword in the early 2000s is being embraced by corporations and Covid-19 may just be the catalyst to make it the norm. 75% of Fortune 500 CEOs surveyed think so too.

The reality of being physically apart has forced corporations to accelerate digitization strategies for their customers, employees and business as usual practices. Using banking as an example, customer complaints of manual paper processes like account opening have to be at least digital if you cannot visit a physical branch. Wet signatures to approve the document have to move to a secured e-signature platform. Efficiency needs to keep up with customer expectations and repetitive but important processes like KYC need to be automated with some form of Artificial Intelligence (AI)/Robotic Process Automation (RPA).

What this likely means for B2B startups is;

- Corporates would have more problem statements around digitization and relevant technologies

- They will have bigger budgets to solve them

- Perhaps more importantly, the buy in that you needed from the head of department is now coming from the group CTO. Once large structural changes are made to go digital, they are unlikely reverted to the old processes of before. This further ignites a cyclical change from the “legacy” organizations to embrace technology or be the only one left behind.

Startups I speak to have experienced cold conversations suddenly turn warm and those in pre-production seen their obstacles cleared to get their product out as quickly as possible during this period. My own portfolio company product has been rolled out months ahead of schedule and peers from other financial institutions tell me the same. This speed of adoption would mostly be unheard of in the banking world if not for this virus. And, I’m hoping this mindset will stay after the virus situation recovers.

Instead of coffee, it’s now zoom.

As CIOs struggle to cope with the 10–100x increase in remote working as governments move employees to work from home (WFH), teleconferencing becomes the new norm of meetings. Also, instead of networking drinks, VCs and startups now play fortnite together (seriously).

What this likely means for startups is:

- Instead of expensive and inefficient travel trips for B2B sales, you can now do it online and close sales. This applies to pitching and closing investment rounds from VCs online too.

- WFH also means remote access for B2B startups is now being granted (or at least working with client’s on premise staff via teleconferencing). Engineers do not need to be in client premises and this means arbitraging labour in cheaper countries; EVEN MORE.

- Collaborative and communications software usage is increased. Corporate firewalls, especially found in banks, start to ease or formal work-arounds are developed. The actual ability to access and use these SaaS tools for corporates creates new opportunities and employees pro-actively explore more tools. The increased usage can create network effects within and between large organizations.

- Traditional on-premise only customers are migrating to a hybrid or cloud solution. Those corporates that were in your long term pipeline could possibly be your customers by December 2020.

- Network improvement and cybersecurity plays likes SD-WAN, Microsegmentation, Multi-factor Authentication, etc. all rise in importance for corporations and move ahead in the queue for getting into production. Especially for the legacy systems customers above. Procurement procedures and onboarding now move quicker for such key systems.

During Singapore’s ‘lock-down’ period, I’ve learnt of a ‘conservative’ local bank allowing a fintech remote access to key data to continue working on an important system. Some startups are now citing onboarding into large banks in weeks instead of months and I’ve seen startups close enterprise sales and VC peer closes deals via video. I have been doing due diligence with a few fintechs purely online and might be closing some deals entirely remotely.

As the world moves out of lockdown, physical human interaction will definitely continue. However, as we’ve seen pure online work in this period, I know deals can be closed with less physical meetings and more efficient video follow ups. I hope that the often nightmarish onboarding procedures will continue to be nimble and MNCs continue to allow more SaaS tools to be accessed via through corporate network firewalls.

Being real;

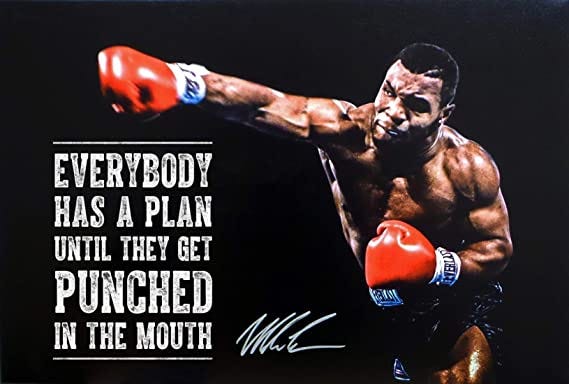

Now, I would like to think of myself as a realistic optimist. I know that there have been many cases when startups lost funding opportunities or large contracts because of the economic environment or they couldn’t meet in person. Overall VC funding has likely been reduced too. The situation is what it is, and we can only decide how we deal with it. I’ll leave you with one of my favourite quotes;

(and see Mike Tysons’ explanation on what he means here)

If you are a founder or working in a startup, nothing is going according to plan and you are now going through the extreme worst case scenario in your projections. How you deal with it will define you and your company. And remember, many great companies were created in bad times. I hope this post can help us try to look a little on the bright side and carry on the best we all can. 💪

If you haven’t, do read these great articles on what to expect, how to better pitch online, and inevitably dealing with layoffs.

Amid 2nd wave fears, and knowing that it may be many months or even years before a vaccine or cure is found, at least we know the world is working together to get there. Fingers crossed, I expect to meet friends from the ecosystem in person soon. An actual cup of cappuccino to catch up sure beats a virtual ☕ over zoom. Stay safe!