Strategic investment will help to establish TruFin as the institutional yield standard for onchain markets. London, United Kingdom, 25 February 2026: TruFin announced a strategic investment led by SC Ventures, the venture building and investment arm of Standard Chartered, with participation from FalconX and Road Capital. The investment supports TruFin’s mission to establish the institutional […]

Strategic investment will help to establish TruFin as the institutional yield standard for onchain markets. London, United Kingdom, 25 February 2026: TruFin announced a strategic investment led by SC Ventures, the venture building and investment arm of Standard Chartered, with participation from FalconX and Road Capital. The investment supports TruFin’s mission to establish the institutional […]

Strategic investment will help to establish TruFin as the institutional yield standard for onchain markets. London, United Kingdom, 25 February 2026: TruFin announced a strategic investment led by SC Ventures, the venture building and investment arm of Standard Chartered, with participation from FalconX and Road Capital. The investment supports TruFin’s mission to establish the institutional […]

Riyadh, Saudi Arabia – February 4th, 2026 – SC Ventures, the innovation, venture-building, and investment arm of Standard Chartered Bank, today announced the signing of a Memorandum of Understanding (MoU) with Sanabil Studio to establish a strategic partnership focused on building and scaling high-impact, SME-focused fintech ventures in Saudi Arabia. The partnership aims to establish a collaborative framework, bringing together […]

Riyadh, Saudi Arabia – February 4th, 2026 – SC Ventures, the innovation, venture-building, and investment arm of Standard Chartered Bank, today announced the signing of a Memorandum of Understanding (MoU) with Sanabil Studio to establish a strategic partnership focused on building and scaling high-impact, SME-focused fintech ventures in Saudi Arabia. The partnership aims to establish a collaborative framework, bringing together […]

Riyadh, Saudi Arabia – February 4th, 2026 – SC Ventures, the innovation, venture-building, and investment arm of Standard Chartered Bank, today announced the signing of a Memorandum of Understanding (MoU) with Sanabil Studio to establish a strategic partnership focused on building and scaling high-impact, SME-focused fintech ventures in Saudi Arabia. The partnership aims to establish a collaborative framework, bringing together […]

Joint venture between Fujitsu and SC Ventures to accelerate quantum innovation in financial services and beyond Kawasaki, Japan, London and Singapore, January 16, 2026 – Fujitsu Limited and SC Ventures today announced the roadmap for Qubitra Technologies, a new joint venture to accelerate quantum capability and value by integrating quantum resources and talent on a […]

Joint venture between Fujitsu and SC Ventures to accelerate quantum innovation in financial services and beyond Kawasaki, Japan, London and Singapore, January 16, 2026 – Fujitsu Limited and SC Ventures today announced the roadmap for Qubitra Technologies, a new joint venture to accelerate quantum capability and value by integrating quantum resources and talent on a […]

Joint venture between Fujitsu and SC Ventures to accelerate quantum innovation in financial services and beyond Kawasaki, Japan, London and Singapore, January 16, 2026 – Fujitsu Limited and SC Ventures today announced the roadmap for Qubitra Technologies, a new joint venture to accelerate quantum capability and value by integrating quantum resources and talent on a […]

Key Highlights Olea has raised US$30 million in Series A from BBVA, XDC Network, theDOCK, and SC Ventures. The proceeds will enable accelerated adoption of AI and Web3 and deliver new solutions across high-growth markets. This investment validates Olea’s institutional-grade and MAS-licensed platform that has facilitated US$3 billion in financing with 30 institutional funders for […]

Key Highlights Olea has raised US$30 million in Series A from BBVA, XDC Network, theDOCK, and SC Ventures. The proceeds will enable accelerated adoption of AI and Web3 and deliver new solutions across high-growth markets. This investment validates Olea’s institutional-grade and MAS-licensed platform that has facilitated US$3 billion in financing with 30 institutional funders for […]

Key Highlights Olea has raised US$30 million in Series A from BBVA, XDC Network, theDOCK, and SC Ventures. The proceeds will enable accelerated adoption of AI and Web3 and deliver new solutions across high-growth markets. This investment validates Olea’s institutional-grade and MAS-licensed platform that has facilitated US$3 billion in financing with 30 institutional funders for […]

Singapore and Japan, September 25, 2025 – SC Ventures by Standard Chartered Bank, which builds and invests in breakthrough ventures in and beyond banking, together with Fujitsu, a leading developer of quantum software and hardware, are joining forces to incubate Project Quanta. The project will integrate multiple software and hardware technologies to provide clients a […]

Singapore and Japan, September 25, 2025 – SC Ventures by Standard Chartered Bank, which builds and invests in breakthrough ventures in and beyond banking, together with Fujitsu, a leading developer of quantum software and hardware, are joining forces to incubate Project Quanta. The project will integrate multiple software and hardware technologies to provide clients a […]

Singapore and Japan, September 25, 2025 – SC Ventures by Standard Chartered Bank, which builds and invests in breakthrough ventures in and beyond banking, together with Fujitsu, a leading developer of quantum software and hardware, are joining forces to incubate Project Quanta. The project will integrate multiple software and hardware technologies to provide clients a […]

Abu Dhabi, UAE / Singapore / Fontainebleau, France– 2 September 2025 – INSEAD, The Business School for the World, and SC Ventures, the innovation and ventures unit of Standard Chartered, today announced the launch of Lexarius, an AI-powered EdTech venture with a bold vision to unlock human potential everywhere by making learning deeply experiential. Lexarius […]

Abu Dhabi, UAE / Singapore / Fontainebleau, France– 2 September 2025 – INSEAD, The Business School for the World, and SC Ventures, the innovation and ventures unit of Standard Chartered, today announced the launch of Lexarius, an AI-powered EdTech venture with a bold vision to unlock human potential everywhere by making learning deeply experiential. Lexarius […]

Abu Dhabi, UAE / Singapore / Fontainebleau, France– 2 September 2025 – INSEAD, The Business School for the World, and SC Ventures, the innovation and ventures unit of Standard Chartered, today announced the launch of Lexarius, an AI-powered EdTech venture with a bold vision to unlock human potential everywhere by making learning deeply experiential. Lexarius […]

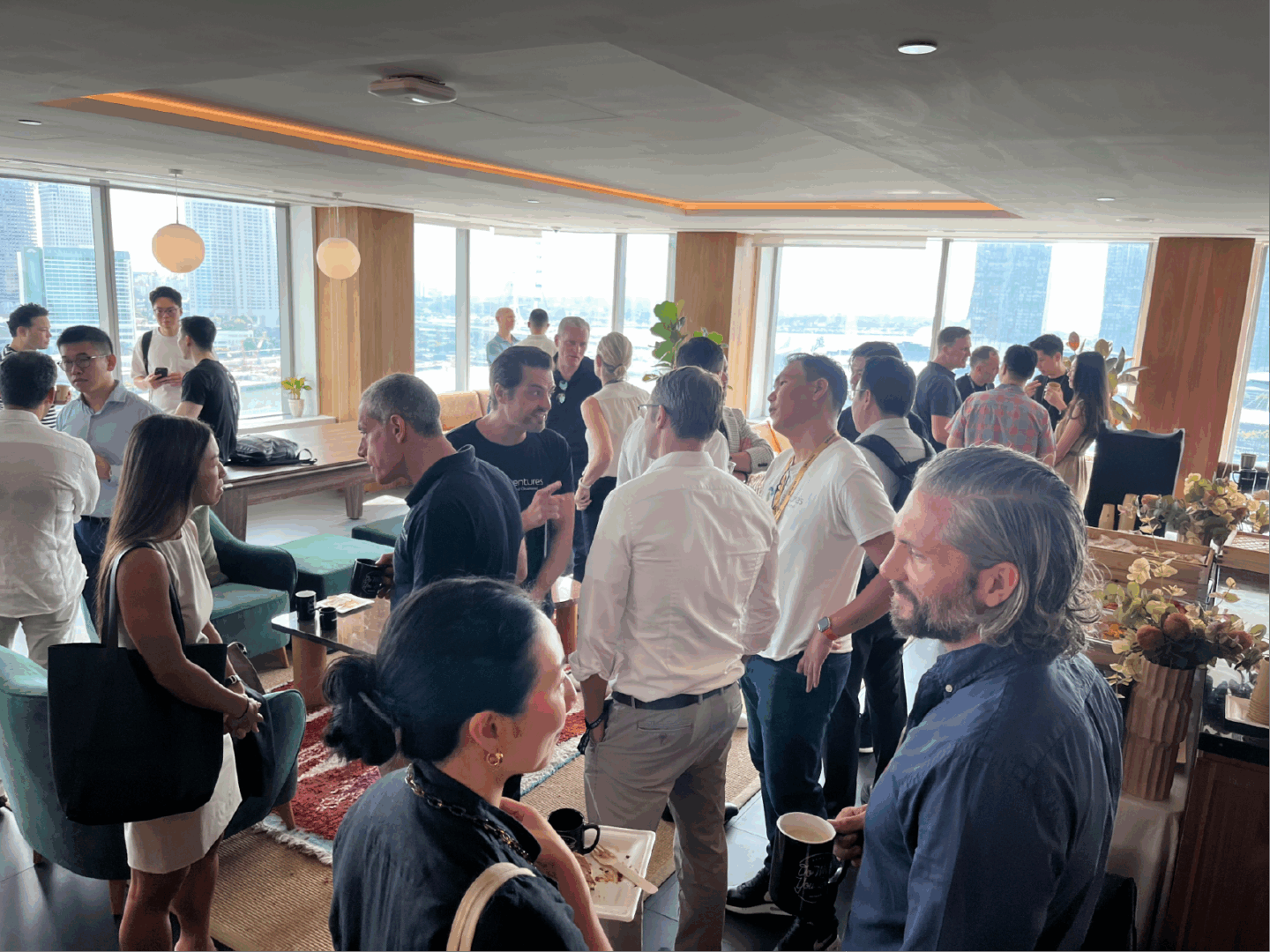

A community for venture builders, investors & founders to connect, collaborate and co-create. Building impactful ventures takes more than great ideas — it takes a village of thinkers, doers, and risk-takers. Ventures Lab by SC Ventures is a community designed to bring together founders, investors, and venture builders to exchange knowledge, explore opportunities, and practice […]

A community for venture builders, investors & founders to connect, collaborate and co-create. Building impactful ventures takes more than great ideas — it takes a village of thinkers, doers, and risk-takers. Ventures Lab by SC Ventures is a community designed to bring together founders, investors, and venture builders to exchange knowledge, explore opportunities, and practice […]

A community for venture builders, investors & founders to connect, collaborate and co-create. Building impactful ventures takes more than great ideas — it takes a village of thinkers, doers, and risk-takers. Ventures Lab by SC Ventures is a community designed to bring together founders, investors, and venture builders to exchange knowledge, explore opportunities, and practice […]

7 August 2025, Singapore – Standard Chartered (“the Bank”) has successfully concluded the second edition of its flagship Young Entrepreneur Programme (YEP) for the next generation of its high-net-worth (HNW) clients under the Priority Private segment. This year’s programme brought together 50 participants of 12 nationalities, a reflection of the Bank’s international network and diversity. […]

7 August 2025, Singapore – Standard Chartered (“the Bank”) has successfully concluded the second edition of its flagship Young Entrepreneur Programme (YEP) for the next generation of its high-net-worth (HNW) clients under the Priority Private segment. This year’s programme brought together 50 participants of 12 nationalities, a reflection of the Bank’s international network and diversity. […]

7 August 2025, Singapore – Standard Chartered (“the Bank”) has successfully concluded the second edition of its flagship Young Entrepreneur Programme (YEP) for the next generation of its high-net-worth (HNW) clients under the Priority Private segment. This year’s programme brought together 50 participants of 12 nationalities, a reflection of the Bank’s international network and diversity. […]

London, Monday 28th July 2025 – Zodia Markets, the digital asset platform enabling institutional capital through stablecoins, has raised $18.25 million in a Series A funding round, as demand for real-time wholesale trading, settlement and cross-border movement via stablecoins skyrockets. The raise was led by Pharsalus Capital, a New York head-quartered venture capital firm, with participation from […]

London, Monday 28th July 2025 – Zodia Markets, the digital asset platform enabling institutional capital through stablecoins, has raised $18.25 million in a Series A funding round, as demand for real-time wholesale trading, settlement and cross-border movement via stablecoins skyrockets. The raise was led by Pharsalus Capital, a New York head-quartered venture capital firm, with participation from […]

London, Monday 28th July 2025 – Zodia Markets, the digital asset platform enabling institutional capital through stablecoins, has raised $18.25 million in a Series A funding round, as demand for real-time wholesale trading, settlement and cross-border movement via stablecoins skyrockets. The raise was led by Pharsalus Capital, a New York head-quartered venture capital firm, with participation from […]

Singapore, July 17, 2025 – SC Ventures by Standard Chartered, which builds and invests in breakthrough ventures in and beyond banking, and Standard Chartered’s Corporate Investment Banking (CIB) division have appointed Lisa Pollina as Vice Chairman, Americas. Pollina will report to Alex Manson, CEO of SC Ventures, and matrix into Mandy DeFilippo, CEO for the […]

Singapore, July 17, 2025 – SC Ventures by Standard Chartered, which builds and invests in breakthrough ventures in and beyond banking, and Standard Chartered’s Corporate Investment Banking (CIB) division have appointed Lisa Pollina as Vice Chairman, Americas. Pollina will report to Alex Manson, CEO of SC Ventures, and matrix into Mandy DeFilippo, CEO for the […]

Singapore, July 17, 2025 – SC Ventures by Standard Chartered, which builds and invests in breakthrough ventures in and beyond banking, and Standard Chartered’s Corporate Investment Banking (CIB) division have appointed Lisa Pollina as Vice Chairman, Americas. Pollina will report to Alex Manson, CEO of SC Ventures, and matrix into Mandy DeFilippo, CEO for the […]

Targeting USD 100M Revenue: FPT and audax Financial Technology aim to generate USD 100 million in revenue over the next three years, driving digital banking innovation across Asia Pacific and the Middle East. Strategic Regional Partnership: FPT becomes audax’s partner in Asia Pacific and the Middle East, providing expertise in cloud-native development, testing, and long-term […]

Targeting USD 100M Revenue: FPT and audax Financial Technology aim to generate USD 100 million in revenue over the next three years, driving digital banking innovation across Asia Pacific and the Middle East. Strategic Regional Partnership: FPT becomes audax’s partner in Asia Pacific and the Middle East, providing expertise in cloud-native development, testing, and long-term […]

Targeting USD 100M Revenue: FPT and audax Financial Technology aim to generate USD 100 million in revenue over the next three years, driving digital banking innovation across Asia Pacific and the Middle East. Strategic Regional Partnership: FPT becomes audax’s partner in Asia Pacific and the Middle East, providing expertise in cloud-native development, testing, and long-term […]

Singapore, June 30, 2025 – SC Ventures by Standard Chartered, which builds and invests in breakthrough ventures in and beyond banking, has completed the sale of its incubated venture, Solv India, to Jumbotail, one of India’s leading B2B marketplaces, post obtaining regulatory approval from Competition Commission of India. The combined business is now one of […]

Singapore, June 30, 2025 – SC Ventures by Standard Chartered, which builds and invests in breakthrough ventures in and beyond banking, has completed the sale of its incubated venture, Solv India, to Jumbotail, one of India’s leading B2B marketplaces, post obtaining regulatory approval from Competition Commission of India. The combined business is now one of […]

Singapore, June 30, 2025 – SC Ventures by Standard Chartered, which builds and invests in breakthrough ventures in and beyond banking, has completed the sale of its incubated venture, Solv India, to Jumbotail, one of India’s leading B2B marketplaces, post obtaining regulatory approval from Competition Commission of India. The combined business is now one of […]

FourTwoThree will leverage PointSource’s powerful data backbone to support small and medium businesses in their climate transition. Singapore, June 24, 2025 – PointSource, a platform that makes climate data usable, is now positioned to scale its impact far beyond what a single venture could achieve alone. PointSource will join forces with FourTwoThree, a smart action […]

FourTwoThree will leverage PointSource’s powerful data backbone to support small and medium businesses in their climate transition. Singapore, June 24, 2025 – PointSource, a platform that makes climate data usable, is now positioned to scale its impact far beyond what a single venture could achieve alone. PointSource will join forces with FourTwoThree, a smart action […]

FourTwoThree will leverage PointSource’s powerful data backbone to support small and medium businesses in their climate transition. Singapore, June 24, 2025 – PointSource, a platform that makes climate data usable, is now positioned to scale its impact far beyond what a single venture could achieve alone. PointSource will join forces with FourTwoThree, a smart action […]

SC Ventures, Standard Chartered’s innovation, FinTech investment and ventures arm, has signed a strategic partnership with DIFC Innovation Hub to launch the National Venture Building Programme, a new initiative aimed at accelerating innovation and supporting venture creation across the region. As part of the collaboration, SC Ventures is providing its Venture Building as a Service […]

SC Ventures, Standard Chartered’s innovation, FinTech investment and ventures arm, has signed a strategic partnership with DIFC Innovation Hub to launch the National Venture Building Programme, a new initiative aimed at accelerating innovation and supporting venture creation across the region. As part of the collaboration, SC Ventures is providing its Venture Building as a Service […]

SC Ventures, Standard Chartered’s innovation, FinTech investment and ventures arm, has signed a strategic partnership with DIFC Innovation Hub to launch the National Venture Building Programme, a new initiative aimed at accelerating innovation and supporting venture creation across the region. As part of the collaboration, SC Ventures is providing its Venture Building as a Service […]

SC Ventures, the innovation, fintech investment, and venture-building arm of Standard Chartered, has signed a Memorandum of Understanding (MoU) with Emirates NBD, a leading banking group in the Middle East, North Africa and Türkiye (MENAT) region, to explore strategic opportunities for collaboration. The collaboration outlines the intent of both parties to jointly explore innovation-led initiatives, […]

SC Ventures, the innovation, fintech investment, and venture-building arm of Standard Chartered, has signed a Memorandum of Understanding (MoU) with Emirates NBD, a leading banking group in the Middle East, North Africa and Türkiye (MENAT) region, to explore strategic opportunities for collaboration. The collaboration outlines the intent of both parties to jointly explore innovation-led initiatives, […]

SC Ventures, the innovation, fintech investment, and venture-building arm of Standard Chartered, has signed a Memorandum of Understanding (MoU) with Emirates NBD, a leading banking group in the Middle East, North Africa and Türkiye (MENAT) region, to explore strategic opportunities for collaboration. The collaboration outlines the intent of both parties to jointly explore innovation-led initiatives, […]

Singapore, April 23, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, has successfully completed two engagements under its Memorandum of Understanding (MoU) with a research institute under Singapore’s Agency for Science, Technology, and Research (A*STAR) — the A*STAR Institute of High Performance Computing (A*STAR IHPC). This collaboration advances the pursuit of […]

Singapore, April 23, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, has successfully completed two engagements under its Memorandum of Understanding (MoU) with a research institute under Singapore’s Agency for Science, Technology, and Research (A*STAR) — the A*STAR Institute of High Performance Computing (A*STAR IHPC). This collaboration advances the pursuit of […]

Singapore, April 23, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, has successfully completed two engagements under its Memorandum of Understanding (MoU) with a research institute under Singapore’s Agency for Science, Technology, and Research (A*STAR) — the A*STAR Institute of High Performance Computing (A*STAR IHPC). This collaboration advances the pursuit of […]

Bangalore, March 26, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, has agreed to the acquisition of its incubated venture, Solv India, by Jumbotail, one of India’s leading B2B marketplaces. The deal is subject to regulatory approvals. Jumbotail and Solv India combined will become a strong, multi-category B2B ecommerce platform […]

Bangalore, March 26, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, has agreed to the acquisition of its incubated venture, Solv India, by Jumbotail, one of India’s leading B2B marketplaces. The deal is subject to regulatory approvals. Jumbotail and Solv India combined will become a strong, multi-category B2B ecommerce platform […]

Bangalore, March 26, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, has agreed to the acquisition of its incubated venture, Solv India, by Jumbotail, one of India’s leading B2B marketplaces. The deal is subject to regulatory approvals. Jumbotail and Solv India combined will become a strong, multi-category B2B ecommerce platform […]

Gautam Jain explains our conviction to empower SMEs through our upcoming venture Project Hal; drive Financial Inclusion through myZoi and Furaha Financial; build the guardrails for a safe and sustainable Digital Assets ecosystem through Zodia Custody, Zodia Markets, Libeara and our $100 million Global Digital Asset Holdings fund; and support the Digital Economy through Appro.ae, […]

Gautam Jain explains our conviction to empower SMEs through our upcoming venture Project Hal; drive Financial Inclusion through myZoi and Furaha Financial; build the guardrails for a safe and sustainable Digital Assets ecosystem through Zodia Custody, Zodia Markets, Libeara and our $100 million Global Digital Asset Holdings fund; and support the Digital Economy through Appro.ae, […]

Gautam Jain explains our conviction to empower SMEs through our upcoming venture Project Hal; drive Financial Inclusion through myZoi and Furaha Financial; build the guardrails for a safe and sustainable Digital Assets ecosystem through Zodia Custody, Zodia Markets, Libeara and our $100 million Global Digital Asset Holdings fund; and support the Digital Economy through Appro.ae, […]

Globally, venture capital deal value inched upward last year, and in the Middle East we witnessed a dynamic shift with deal activity surging to an overall value of USD 1.5 billion. SC Ventures had a strong year: we expanded from 2 to 7 ventures across the Middle East, created over 150 jobs, closed more than […]

Globally, venture capital deal value inched upward last year, and in the Middle East we witnessed a dynamic shift with deal activity surging to an overall value of USD 1.5 billion. SC Ventures had a strong year: we expanded from 2 to 7 ventures across the Middle East, created over 150 jobs, closed more than […]

Globally, venture capital deal value inched upward last year, and in the Middle East we witnessed a dynamic shift with deal activity surging to an overall value of USD 1.5 billion. SC Ventures had a strong year: we expanded from 2 to 7 ventures across the Middle East, created over 150 jobs, closed more than […]

Source: Economy Middle East Published: Mon 3 Mar 2025, 10:38 AM SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, signed today a memorandum of understanding with Visa to develop solutions aimed at supporting small and medium-sized enterprises (SMEs) across the Middle East and North Africa (MENA) region. “This partnership represents a critical milestone in […]

Source: Economy Middle East Published: Mon 3 Mar 2025, 10:38 AM SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, signed today a memorandum of understanding with Visa to develop solutions aimed at supporting small and medium-sized enterprises (SMEs) across the Middle East and North Africa (MENA) region. “This partnership represents a critical milestone in […]

Source: Economy Middle East Published: Mon 3 Mar 2025, 10:38 AM SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, signed today a memorandum of understanding with Visa to develop solutions aimed at supporting small and medium-sized enterprises (SMEs) across the Middle East and North Africa (MENA) region. “This partnership represents a critical milestone in […]

Furaha combines SC Ventures’ global expertise and risk management capability with Yabx’s future-ready tech and alternate lending platform Furaha offers purpose-driven loans centred around education, gender and other responsible lending pillars for African markets Davos, Jan. 24, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, and Yabx Technologies (Netherlands) B.V., a […]

Furaha combines SC Ventures’ global expertise and risk management capability with Yabx’s future-ready tech and alternate lending platform Furaha offers purpose-driven loans centred around education, gender and other responsible lending pillars for African markets Davos, Jan. 24, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, and Yabx Technologies (Netherlands) B.V., a […]

Furaha combines SC Ventures’ global expertise and risk management capability with Yabx’s future-ready tech and alternate lending platform Furaha offers purpose-driven loans centred around education, gender and other responsible lending pillars for African markets Davos, Jan. 24, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, and Yabx Technologies (Netherlands) B.V., a […]

Singapore, January 23, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, in partnership with KiyaAI, a digital solutions provider, is launching Akashaverse, an entertainment, social, ecommerce and lifestyle hub using immersive technologies and artificial intelligence. Akashaverse will explore immersive and interactive digital environments and intends to transform how people experience and […]

Singapore, January 23, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, in partnership with KiyaAI, a digital solutions provider, is launching Akashaverse, an entertainment, social, ecommerce and lifestyle hub using immersive technologies and artificial intelligence. Akashaverse will explore immersive and interactive digital environments and intends to transform how people experience and […]

Singapore, January 23, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, in partnership with KiyaAI, a digital solutions provider, is launching Akashaverse, an entertainment, social, ecommerce and lifestyle hub using immersive technologies and artificial intelligence. Akashaverse will explore immersive and interactive digital environments and intends to transform how people experience and […]

Melbourne fintech Eden Exchange acquires Dealcierge from SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm Creating a complete end-to-end platform for market services in APAC for buying and selling businesses Targeting underserviced SME transactions, enabling deal and capital flow across borders 20 January 2025, Melbourne/Singapore: Australian fintech Eden Exchange has acquired SC Venture’s […]

Melbourne fintech Eden Exchange acquires Dealcierge from SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm Creating a complete end-to-end platform for market services in APAC for buying and selling businesses Targeting underserviced SME transactions, enabling deal and capital flow across borders 20 January 2025, Melbourne/Singapore: Australian fintech Eden Exchange has acquired SC Venture’s […]

Melbourne fintech Eden Exchange acquires Dealcierge from SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm Creating a complete end-to-end platform for market services in APAC for buying and selling businesses Targeting underserviced SME transactions, enabling deal and capital flow across borders 20 January 2025, Melbourne/Singapore: Australian fintech Eden Exchange has acquired SC Venture’s […]

Singapore, January 13, 2024 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, in collaboration with ENGIE Factory, the startup studio of French multinational utility ENGIE Group, are launching Qatalyst, a due diligence platform for carbon finance markets that facilitates efficient and transparent investment processes in support of global climate goals. “We are […]

Singapore, January 13, 2024 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, in collaboration with ENGIE Factory, the startup studio of French multinational utility ENGIE Group, are launching Qatalyst, a due diligence platform for carbon finance markets that facilitates efficient and transparent investment processes in support of global climate goals. “We are […]

Singapore, January 13, 2024 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, in collaboration with ENGIE Factory, the startup studio of French multinational utility ENGIE Group, are launching Qatalyst, a due diligence platform for carbon finance markets that facilitates efficient and transparent investment processes in support of global climate goals. “We are […]

We care about your experience online, that's why we use cookies to make sure our website runs smoothly while personalising your visit for your ease of use and convenience. To choose what cookies you want to accept, select "Manage Cookies". To reject all cookies (except essential cookies), select "Accept essential cookies only". To accept all cookies for the best possible experience, select "Accept all". To change your cookie preference, please ensure that cookie/browsing history is cleared. If you'd like to learn about how we use cookies and to manage your selection, visit our cookie policy.

Tell us which cookie categories you consent to by using the sliders below. You can change your preferences any time by clicking on the 'Manage Cookies' link under LEGAL in the footer.

Your security and privacy are our top priority, that's why these cookies are always on to ensure the safest and smoothest online experience.

For your ease of use and convenience, these cookies remember the choices you made (e.g. language and region) and personalise our website to make it most relevant for you.

Imperva provides cybersecurity solutions to protect data and applications from threats and ensure compliance.

LinkedIn is a professional networking platform for job seekers, employers, and industry connections.

These cookies are used for managing login functionality on this website.

To create the best and most relevant experience for you, these cookies help us analyse and understand what areas need to be improved and refined.

Google Tag Manager simplifies the management of marketing tags on your website without code changes.

To make sure we only send what’s most relevant to your needs, these cookies help us and our partners understand what matters most to you. The data collected can be shared with third parties, such as advertisers or platforms, to create an ecosystem that is always relevant to you.

LinkedIn is a professional networking platform for job seekers, employers, and industry connections.