By: Alex Manson, SC Ventures

Well… we didn’t see that one coming!

Last year was painful for most people, to varying degrees – at times tragic with the loss of loved ones, emerging forms of mental illness, loss of jobs and means of living. The gap between rich and poor increased and humanity suffered a set-back on about every Sustainable Development Goal (SDG). Sometimes the impact was less tragic but uncomfortable – separated families and drastic changes to our ways of life (no travel, limited human contact).

The inspiring story all around though, is humans’ remarkable ability to adapt – to the “new normal”, “living with the virus”, “work during the pandemic”. This may bode well for the numerous and perhaps bigger challenges ahead, such as fighting climate change, financial and other forms of inclusion, and creating wealth and growth in parts of the world that need it the most.

Rewiring the DNA in banking

At SC Ventures and in every one of our ventures, I guess we had our fair share of difficult stories last year. Nevertheless, I found that the prevalent feeling was a sense of being privileged – having a job and one that could actually be done at a distance, and also a sense of responsibility for achieving our objectives, so that such privilege would not go to waste. Even perhaps, especially as Fintechs, portfolio companies and ventures had to survive so they could fight another day, “Rewiring the DNA in banking” was more relevant than ever for the communities around us. As a group, we continue to take it to heart.

Building and scaling up new business models

First, it is gratifying to see ventures and other projects “coming out” as we have been working on some of these for some time. One of the findings of the pandemic is that in lockdown or online conditions, it is actually easier and sometimes quite efficient to deliver things we have agreed on with people we already know, than to create new things with people we don’t know.

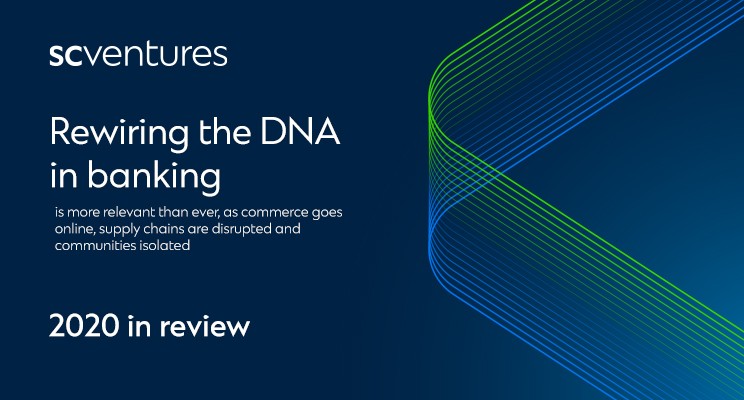

Accordingly, we delivered on a lot, with the intensity we are capable of – and it worked. Mox (our Hong Kong digital bank) and Solv (e-commerce platform serving SMEs in India) both launched commercially. Also, nexus (BaaS business plugging SCB into e-commerce platforms) announced their second partnership in Indonesia and is getting ready to launch in Q1. So is Zodia (institutional proposition for cryptocurrency custody) who also announced a partnership with Northern Trust. Assembly Payments (aggregation of merchants’ payments) is now an operational venture scaling quickly and CardsPal (credit card benefits optimization), which following its commercial launch topped the popularity charts in Singapore (way ahead of Tinder… triggering many jokes in the team). Meanwhile, Autumn (health, wealth and retirement planning platform) has been testing in Singapore in a restricted environment (beta launch expected shortly) and Bloom (safe and compliant cloud infrastructure for Fintechs and regulated financial institutions) is finalizing arrangements for testing their prototype with sophisticated clients.

A number of other ventures are coming right on the heels of these, so stay tuned. This year we will continue to execute and scale the ventures that are coming to market. But we will also turn our attention to creating new things with people we don’t necessarily know (because we can, and because we should).

Investing in fintech partnerships

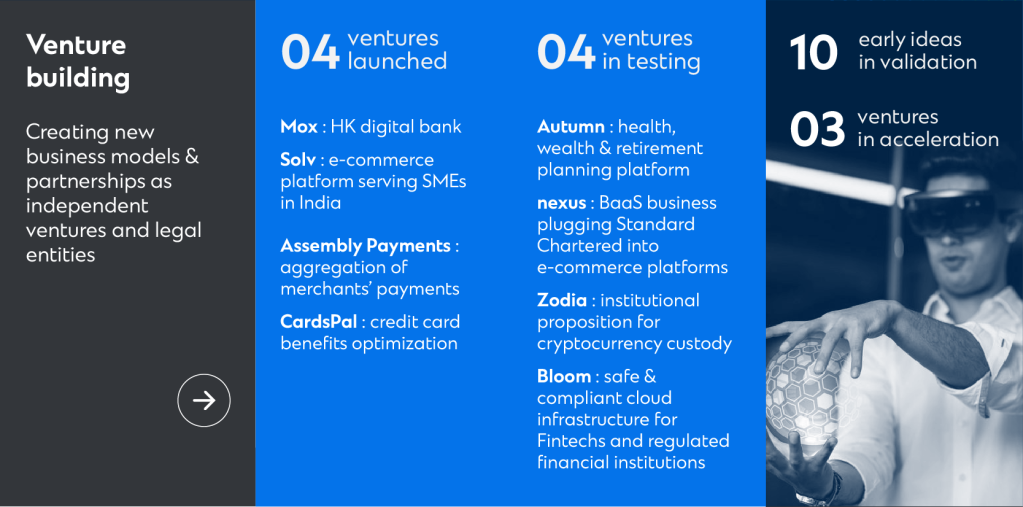

On the investment front, the team experienced arguably its first crisis. Take a step back, reflect on the portfolio, prioritise resources for those who can justify their scarce allocation. Some of the companies we expected to struggle did not – others we did not expect did.

Perhaps the highlight of this year was SC Ventures stepping up and rescuing one of our partners, a sound business which had just overextended itself on the brink of the pandemic. This was a small deal for the Bank, but a successful one and perhaps a case study of how banking should be done – saving jobs and a company solving problems that are worth solving on the way.

Towards the end of the year we reflected on themes. As the world goes inexorably more digital, we focused more on infrastructure and security plays that are so critical to banking and deployed new capital accordingly.

Keeping the intrapreneurial spirit alive

Perhaps most importantly, the bank came with us – one intrapreneur at a time. Of course, we wouldn’t be here without senior management support and we are both cognizant and forever grateful of the opportunity their trust has enabled. But it is with individuals all around the bank, at any level of seniority and from every walk of life, that we have achieved the most “transformational impact”.

Intrapreneurs, the ones volunteering to come forward and realize one of their aspirations, have joined the programme. Irrespective of whether they were able to go all the way with their ideas, they will never be the same professionals again. They have already become leaders of the future. They are also an integral part of the SC Ventures family, kindred spirits driven to make the world a better place by making banking better. I am proud of them all and wanted to thank them first for being their authentic selves.

Transforming the way we work

We also experimented with ways of working. OKR discipline is now more a routine for us as we are maturing and executing with “self-administration”. This is done within a structure that we wish to be as flat and non-hierarchical as possible – no it is not perfect, in fact far from it, and yes it is sometimes a bit messy – where SC Ventures, the ventures, intrapreneurs and subject matter experts around the world share in the common purpose of “Rewiring the DNA in banking”.

This coming year, we will focus on taking the whole bank with us. On day 1, and paraphrasing a great leader, ‘nobody owes you a living’, so we had to execute our first assignments with a level of intensity which can be uncomfortable for some but necessary to survive. Today we need to scale and cannot do it alone – we need everyone to help somehow.

Going from a “start-up” to a “scale-up” also implies maturity in governance. At times we are almost “writing the book” on how ventures can be created in a regulated environment – safely, compliant, but also pioneering, agile, enlightened as business should be and always with purpose in mind (“Rewiring the DNA in banking”!).

Looking ahead to this year

I am proud and thankful for the past year. I’m also anxious about achieving what we promised, because it is my nature, but also unabashedly hopeful and relentless as I think of this year. “There’s “so little done, so much to do.” Please support our effort, we will need all the help we can get.

And for 2020, again – thank you.

Alex