AI Agents are top of mind right now for many of us. However, the term “agent” is often stretched too far — and there are honestly way too many definitions and applications in flux claiming to be of what an agent is or does.

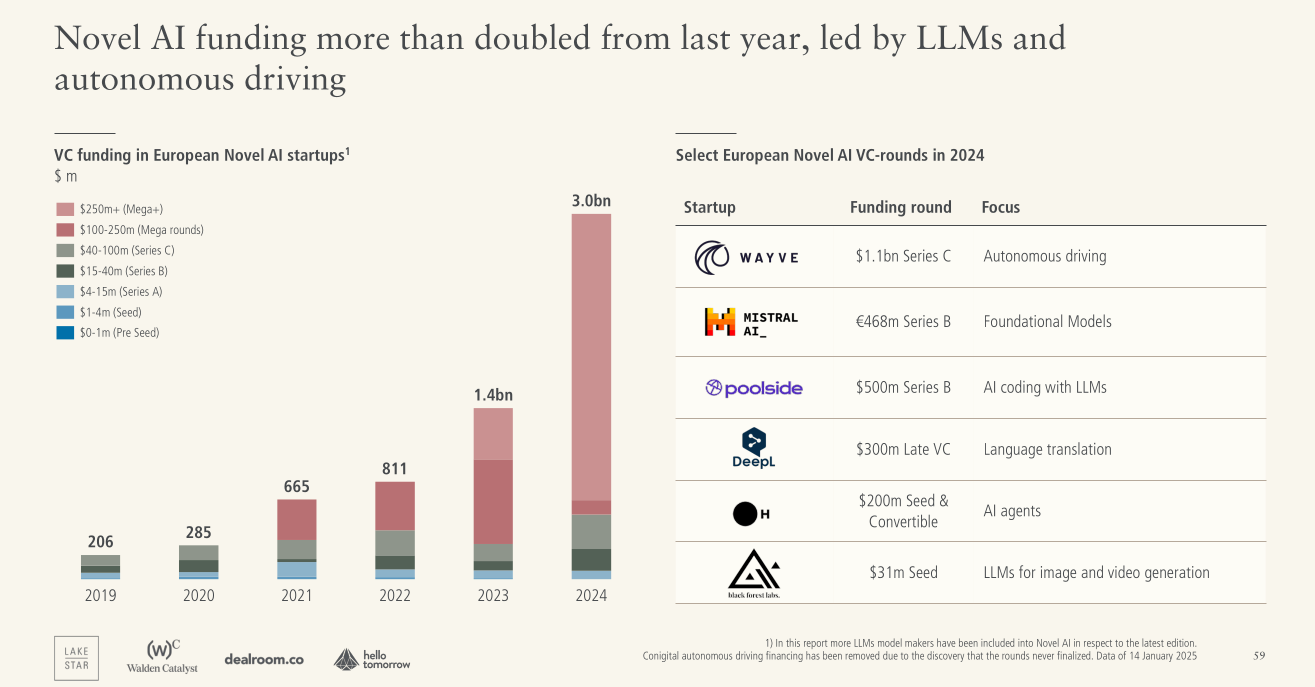

Despite Manus’s success, I don’t think that AI agents are just LLMs in a Claude 3.7 wrapper. True agents can operate autonomously within constraints, execute tasks based on objectives, and adapt to feedback. And since there is still so much misunderstanding, it leads to many inexperienced investors not seeing it’s full potential. If you consider the notoriously laggy European DeepTech investments scene, AI Agent tech is still a niche investment opportunity compared to more established markets like autonomous driving or foundation models.

Btw, what ever happened to Aleph Alpha? I guess they still haven’t launched anything.

source

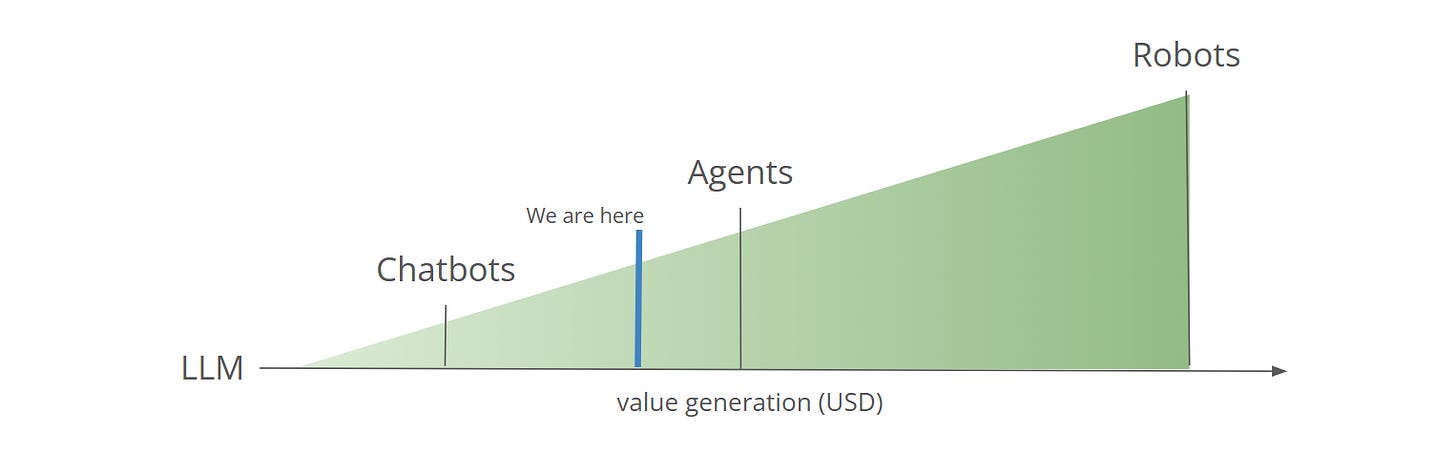

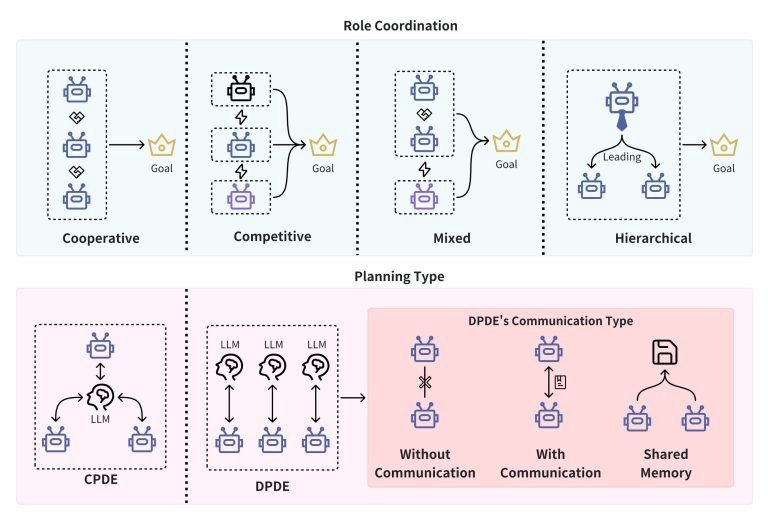

What makes agents different is that they are neither static software nor simple automation scripts—they're decision-making systems capable of reasoning, optimization, and interactions. The distinction between foundation models and agents is critical: foundation models are passive, responding only to prompts, whereas agents act with autonomy, making decisions and taking actions based on learned objectives. Thus the evolution from rule-based automation to fully autonomous decision-making systems is where the fundamental business opportunities lie.

In my opinion, software-based agents are paving the way for full real-life autonomous agents in physical bodies. I.e., robots.

And that is where an order of magnitude more value is generated.

And if you think agents writing emails is cool. Think again.

So you want to exploit that business opportunity?

In this post I will explore some ideas how to do that.

Monetization: Where AI Agents Extract Value

The first questions when evaluating a business opportunity is to understand the underlying business model. As of March 2025, I have identified 7 core business models that help businesses to optimize cost structures and create new revenue streams.

All models hinge on the company’s ability to augment human effort efficiently.

source

Let’s dive right in.

Subscription-Based AaaS (Agent-as-a-Service)

Despite the unfortunate acronym, it’s the obvious and most common one.

Business Model

Offer AI agents as a cloud-based service with tiered pricing — often freemium.

🔹 Example: An AI research assistant is given the task to summarize and analyze papers for scientists. Or, an assistant that translates text into another language.

🔹 Opportunity: Identify and automate tasks that currently require high labor costs (e.g., programming, legal research, financial research).

Risks

In 2025, the borders to enter the AaaS market are incredibly small. Every new agent framework opens further doors. Therefore having attention from your audience, i.e., your market, is critical for success. Usually, if there are a lot of people speaking, raising your voice through marketing increases.

As a result, your customer acquisition cost (CAC) will be high therefore suppressing profits. While you are onboarding customers, the quality of foundation models increases and competitors might leapfrog you. Therefore the churn rate, i.e., the rate by which users may cancel subscriptions should be managed. Finally, as the pizza attack problem showed, new modes with higher intelligence will come at higher compute costs. This will be more expensive leading to eroding margins.

Transaction Fees & Revenue Share

Another example is not currently much practiced, but I think it will become important in agent-to-agent and agent-to-API engagements. More importantly, it is a business model that moves away from a task-based economy to a decision-based economy.

Business Model

Receive a commission or fee for transactions facilitated by the agent.

🔹 Example: AI-driven e-commerce advisors that recommend products and take a cut from sales. Or, collections agents that take a small percentage of the amount collected.

🔹 Opportunity: Plug into affiliate, trading, or payments networks and earn through automated and traceable agent-driven decision-making.

Risks

Getting into this ecosystem will be hard and relies on getting access from third parties. Moreover, if these marketplaces or partners change their access or their fee structures, earnings will drop. Moreover, usually, this form of fee structure must be a low percentage and thus rely upon volumes to gain traction. If you consider recommendation engines, then commissions might only be paid if they lead to actual purchases. If there is no click-through, then the solution might not run profitably. And then there is regulatory risk. Some industries (e.g., finance, health) have strict rules around the use of AI and obligations to auditors and regulators. This usually increases costs and steep fines if something goes wrong.

Lead Generation & Advertising

Another way to earn money with an agent is to send them into the depths of the interwebs and autonomously become the ad — you are chatting with a person on social media only to realize that they are pushing a service.

Business Model

Agents collect user intent data and match them with relevant businesses.

🔹 Example: A travel-planning AI that suggests flights and hotels, earning commissions on bookings.

🔹 Opportunity: Offer personalized recommendations where ad targeting is weak (e.g., niche B2B services).

Risks

The immediate concern when collecting user data for ad monetization is Data Privacy Compliance as this could trigger GDPR/CCPA violations. Besides that Ad Revenue can be highly volatile and advertisers might only engage with your agents if they reach a sizable audience (see the prior point about the audience). Also, there is a material risk that algorithm updates from Google, Facebook, or other ad-partner networks can kill earnings overnight. Finally, transparency on Click Fraud & Fake Leads is important. A key quality driver for this business model is to ensure advertisers that they pay for the right audience otherwise they may refuse payouts if AI-generated leads aren’t converting.

Custom Development & Licensing

Business Model

Build domain-specific vertical AI agents for enterprises and charge for implementation and ongoing support.

🔹 Example: A manufacturing firm deploying an AI that evaluates the quality of a produced good.

🔹 Opportunity: White-label AI solutions for industries lagging in AI adoption (e.g., construction, healthcare).

Risks

Engaging Enterprises takes a long time, onboarding them even more. Depending on a few large customers can lead to concentration risk as you depend on them to survive thus losing just a few of these major clients could severely impact revenue. Further, enterprise implementations are highly complex, where agents may fail to work smoothly with clients' legacy systems, leading to refunds or disputes. The immaturity of agent tech and the speed of development in that area will lead to timing gaps where the deployed agent is already outdated the moment it goes life.

Agent Marketplaces

I believe this will be the final state of Hugging Face.

Business Model

A platform where users can rent/buy specialized agents.

🔹 Example: A marketplace of AI trading bots for retail investors.

🔹 Opportunity: Curate high-performing agents and take a cut from transactions.

Risks

Building marketplaces has always been an expensive endeavor. Usually, the sellers are easy to source since they always look for an audience, but they might be hard to keep or they find it not useful to maintain their profile if the buyers are not there. Thus market making and creating sufficient transactions will be a challenge. Secondly, there is again regulatory scrutiny — Selling financial, legal, or medical agents will require licenses. Also, the old adage of platform risk holds true. While in 2025 BigTech has become a slow-moving behemoth, I believe most AI companies will try their luck and launch a marketplace eventually. Therefore you need to find a way to be more sticky and keep your audience on your marketplace.

Hint: customer experience with a human touch is a key value driver for stickiness.

API & Infrastructure Monetization

Agent-to-agent architectures might unlock completely new ideas on how to conduct business in the industry 5.0.

Business Model

Charge for API access to high-performing / high-skill AI agents. We have seen the beginning of that with OpenAI pro priced at USD 200 p.m. But Sam Altman already thinks of agents that “earn” USD 20K per month.

🔹Example: An AI negotiation agent that helps businesses finalize a commercial transaction (investment banking). Or an agent that automatically adjusts the business’s APIs securely to new needs.

🔹Opportunity: Offer plug-and-play automation where APIs are missing (e.g., B2B procurement).

Risks

As we know from the communication around Stargate, compute on that level will be expensive and require a lot of energy. But I believe it will be worth it. However, these much more capable models will require higher-tier hardware thus base inference cost will be extremely expensive. Also, due to the price tag revenue will be unstable. Since the cost of operations is high, any API abuse, hacking, or misuse will lead to substantial liability issues.

The “Chimera” - Human-AI Hybrid Services

The co-pilot is a currently well-discussed model and is very similar to the agents that I have built for Mercedes.

Business Model

Here, agents assist human experts and help them reduce costs and increase productivity. Productivity is a key driver of economic well-being.

🔹 Example: A personal finance AI that suggests tax strategies, with human experts handling complex cases.

🔹 Opportunity: Blend automation with human oversight to target premium clients.

Risks

Digital transformation is always a journey of cultural change. While the tech might be easy, training people and getting acceptance from their new coworkers adds costs and decreases profit margins. But their specific domain expertise usually should make it worthwhile. Moreover, since there is always a human in the loop, this business model will always face scalability challenges. Since there is a human in the loop, there is a clear accountable party, but still, there is a legal liability if the AI summarizes incorrectly, or generates bad advice. This could lead to lawsuits and fines.

- Legal Liability: If AI advice leads to mistakes (e.g., bad tax advice), lawsuits or fines could follow.

Bonus Addition

Creating and selling synthetic data that provide AI agents with new test cases to study creates an entirely new monetization layer: selling refined, high-quality synthetic datasets for model training, particularly in regulated industries like finance. Here, agents operating in financial services can optimize high-frequency trading strategies, detect fraud, or conduct risk assessments autonomously, capturing arbitrage that traditional firms are too slow to act on.

Business Model Risks: Compute, Dependence, and Regulation

Every AI business model comes with important structural risks. Compute costs remain an issue, and scaling AI inference will quickly erode margins if not factored into the pricing model —especially for consumer-facing applications where a natural limit of USD 20 per months exists. Many models depend on third parties—whether ad networks, cloud providers, or marketplaces—leaving businesses exposed to platform risks. Regulatory scrutiny is inevitable, especially for financial, legal, or medical AI. The most antifragile businesses will be those that fully understand and manage these risks—whether that’s AaaS, ad-driven monetization, affiliate fees, or others. The strongest AI businesses will be those that minimize third-party dependencies and control their own infrastructure, data pipelines, or customer access.

Companies relying on a major provider like OpenAI, Google, or Anthropic for foundational models will be forced into lower-margin businesses as these providers consolidate their market power. Owning proprietary models or deploying AI on edge devices reduces long-term exposure to these risks. Similarly, reliance on real-time market data APIs for AI-driven trading strategies exposes companies to data access costs that can quickly erode profits. The optimal strategy is to integrate multiple sources of proprietary and open datasets to maintain flexibility.

Another major risk factor is regulation. AI models that make autonomous decisions in finance, healthcare, or law will face heightened scrutiny. Compliance with evolving regulatory frameworks will determine whether AI-powered financial advisory tools, autonomous medical diagnostics, or AI-driven contract negotiations can operate at scale. The companies that build regulatory compliance into their business models early will have a strategic advantage over those that ignore it until enforcement begins.

How will the market shift? — From Chatbots to Fully Autonomous Agents

I think the shift is already underway. But there is one major distinction to make! Chatbots are transactional—agents are goal-driven.

Simple customer service bots will continue to exist and add value, but the real value unlock will consolidate around agents capable of executing workflows end-to-end. AI operators—handling cloud deployments (automated terraform!), financial transactions (automated market making), or procurement—will define the next wave of automation. Autonomous robotics, from last-mile delivery bots to factory automation, will reshape industries where labor is expensive, scarce, or where its dangerous for humans — like in space.

In strategic gaming, for example, reinforcement learning agents showcase AI’s ability to learn, adapt, and optimize decisions autonomously. These same principles apply to financial modeling, supply chain optimization, and real-time bidding for advertising. AI agents capable of reasoning over long time horizons will dominate industries that depend on predictive analytics, from financial markets to logistics.

We are already seeing a shift from basic LLM-based chatbots to multi-modal AI agents that integrate with real-world data streams, reason over complex problems, and execute autonomous actions. The next evolution will be AI agents that operate in dynamic environments, making independent decisions without human input.

The biggest wins won’t come from selling AI as a service, but from owning the work AI replaces. The most valuable AI businesses will be those that internalize agent-driven arbitrage rather than leasing it out.

Where does your AI business sit in this equation?