A digital banking service that combines the reach of Bukalapak’s all-commerce platform and the technology of Standard Chartered’s Banking-as-a-Service solution to offer users greater convenience, security; and drive financial inclusion.

- BukaTabungan, the first digital banking service from Bukalapak in partnership with Standard Chartered, provides digital banking access to Bukalapak’s ecosystem of more than 110 million users and 20 million business owners, including the underbanked segment in Indonesia.

- Leveraging nexus, a Banking-as-a-Service solution powered by Standard Chartered that promises bank-grade security.

- Offers a truly paperless onboarding process, with users being able to open their accounts in as quickly as five minutes.

Jakarta, 5 September 2022 – Indonesia’s first public-listed technology company, Bukalapak, and Standard Chartered officially launched BukaTabungan, a digital banking service that leverages the reach of Bukalapak’s all-commerce platform and the technology of nexus, a Banking-as-a-Service (BaaS) solution powered by Standard Chartered. This follows from an earlier announcement on their strategic partnership to launch innovative offerings in efforts to advance their focus on digital banking, and widen financial inclusion to the country’s underbanked segment.

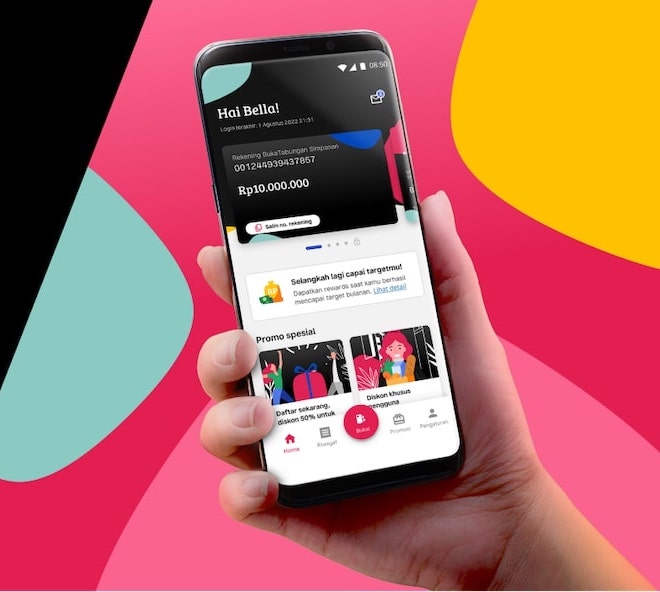

BukaTabungan, a service within Bukalapak’s platform, will offer banking services that are inclusive, easy, and secure to Bukalapak’s ecosystem of over 110 million users and 20 million business owners, enhanced by a completely digital, non-face-to-face onboarding experience. Using advanced automation and security technologies employing artificial intelligence, biometric facial recognition and E-KTP (Indonesia’s biometrics-enabled ID programme) validation, opening an account on BukaTabungan is truly paperless.

Through offering banking access, BukaTabungan also aims to support the business continuity and development of Micro, Small and Medium Enterprises (MSMEs) who make up 97% of Indonesia’s workforce[1], many of whom lack access to formal financing and are still recovering from the impact of the COVID-19 outbreak. Bukalapak currently serves 6.8 million online merchants through its marketplace; 14.2 million businesses (including small family-owned kiosks known as ‘warungs’ and phone credit stores) through its online-to-offline platform, Mitra Bukalapak; and more than 110 million users throughout Indonesia, who mostly transact outside Tier-1 cities. With the launch of BukaTabungan, business owners and the general public will be able to enjoy the convenience of world-class banking services in the palm of their hands, anytime and anywhere.

[1] World Economic Forum: How digitalization is accelerating the growth of MSMEs in Indonesia, 2022

The collaboration between Bukalapak and Standard Chartered is strengthened by the two organisations’ strong commitment to their shared vision of bridging the financial inclusion gap and driving sustainable impact in emerging markets.

President, Commerce & Fintech Bukalapak, Victor Lesmana, said:

“BukaTabungan will be an interesting product because now, everyone in Indonesia within all levels of society will be able to access world-class digital banking services seamlessly and securely. Business owners now also have access to financial services to support their business from a reputable financial institution. We are very excited because this is in line with our mission to support the growth of MSMEs in Indonesia and continue to expand financial inclusion across the country. Our greatest appreciation to Standard Chartered for the trust and shared passion in this collaboration.”

Andrew Chia, Cluster CEO, Indonesia and ASEAN Markets (Australia, Brunei, and the Philippines), Standard Chartered, said:

“We are proud to partner with Bukalapak to launch BukaTabungan, one of Indonesia’s first digital banking services, combining Bukalapak’s e-commerce ecosystem with Standard Chartered’s banking expertise. This partnership will advance the digital banking services landscape and technology ecosystem; particularly through the adoption of nexus, our Banking-as-a-Service solution. We hope the services offered by BukaTabungan will be well received by everyone in Indonesia, bringing us closer to achieving our shared mission of improving financial inclusion for all Indonesians.”

More about BukaTabungan’s proposition

BukaTabungan offers many interesting benefits to its users, including the convenience of opening an account in as quickly as five minutes, no administrative fee for savings, up to 20 free transfers (terms and conditions applied) and cash withdrawals per month, as well as higher interest rates on savings.

BukaTabungan users can also enjoy several promotional offers until the end of October 2022, including bonus interest of up to 7% on savings, direct cashback worth Rp 100,000 for each successful account opened, a special referral programme for Bukalapak users, and special discounts for Bukalapak and Mitra Bukalapak users.

Standard Chartered is licensed and supervised by the OJK, and BukaTabungan has received approval from OJK and Bank Indonesia.

Learn more at bukatabungan.com.

BukaTabungan is now available on Google Play Store and will soon be available on the App Store.

— ENDS —

For further information please contact:

Diana Mudadalam

Head of Corporate Affairs and Brand & Marketing

Indonesia & ASEAN Markets (Australia, Brunei, and the Philippines)

Standard Chartered

corporateaffairs.indonesia@sc.com

Monica Chua

Head of Public Relations Bureau

Bukalapak

corcom@bukalapak.com

Standard Chartered

We are a leading international banking group, with a presence in 59 of the world’s most dynamic markets and serving clients in a further 83. Our purpose is to drive commerce and prosperity through our unique diversity, and our heritage and values are expressed in our brand promise, here for good.

Standard Chartered PLC is listed on the London and Hong Kong Stock Exchanges. For more stories and expert opinions please visit Insights at sc.com. Follow Standard Chartered on Twitter, LinkedIn and Facebook.

Standard Chartered Bank Indonesia is a banking institution that is licensed and supervised by the Financial Services Authority (OJK) and is a member of the Deposit Insurance Corporation (LPS).

About Bukalapak

BUKA is a group of tech-based companies and a technology super-enabler for Indonesia’s MSME transformation and various business verticals.

Building on our heritage serving more than 110 million users and over 20 million Indonesian MSMEs through our various solutions, and as the first publicly-listed Indonesian technology company, we are now focused squarely on using technology to enable today’s digital lifestyles for both Indonesian MSMEs as well as Indonesians in general, across numerous verticals from marketplace, finance and fintech, offline to online, merchant solutions and procurement.

Utilizing our more than a decade long of technology innovation for Indonesian consumers and businesses, BUKA is a tech enabler and fuel of Indonesia’s digital transformation engine.

For more information on BUKA, visit about.bukalapak.com