Olea secures US$30 million Series A funding to accelerate innovation in global trade finance

Key Highlights Olea has raised US$30 million in Series A from BBVA, XDC Network, theDOCK, and SC Ventures. The proceeds will enable accelerated adoption of AI and Web3 and deliver new solutions across high-growth markets. This investment validates Olea’s institutional-grade and MAS-licensed platform that has facilitated US$3 billion in financing with 30 institutional funders for […]

NusaVest: Providing first-of-its-kind asset-backed securities investment opportunities in Southeast Asia

Project 37C: Shaping the next generation of digital asset markets with security, compliance and global expertise that defines our ecosystem

SC Ventures and Fujitsu join forces to incubate Project Quanta

Singapore and Japan, September 25, 2025 – SC Ventures by Standard Chartered Bank, which builds and invests in breakthrough ventures in and beyond banking, together with Fujitsu, a leading developer of quantum software and hardware, are joining forces to incubate Project Quanta. The project will integrate multiple software and hardware technologies to provide clients a […]

INSEAD and SC Ventures Launch Lexarius – an AI-Powered Conversational Platform, Reimagining Learning & Development

Abu Dhabi, UAE / Singapore / Fontainebleau, France– 2 September 2025 – INSEAD, The Business School for the World, and SC Ventures, the innovation and ventures unit of Standard Chartered, today announced the launch of Lexarius, an AI-powered EdTech venture with a bold vision to unlock human potential everywhere by making learning deeply experiential. Lexarius […]

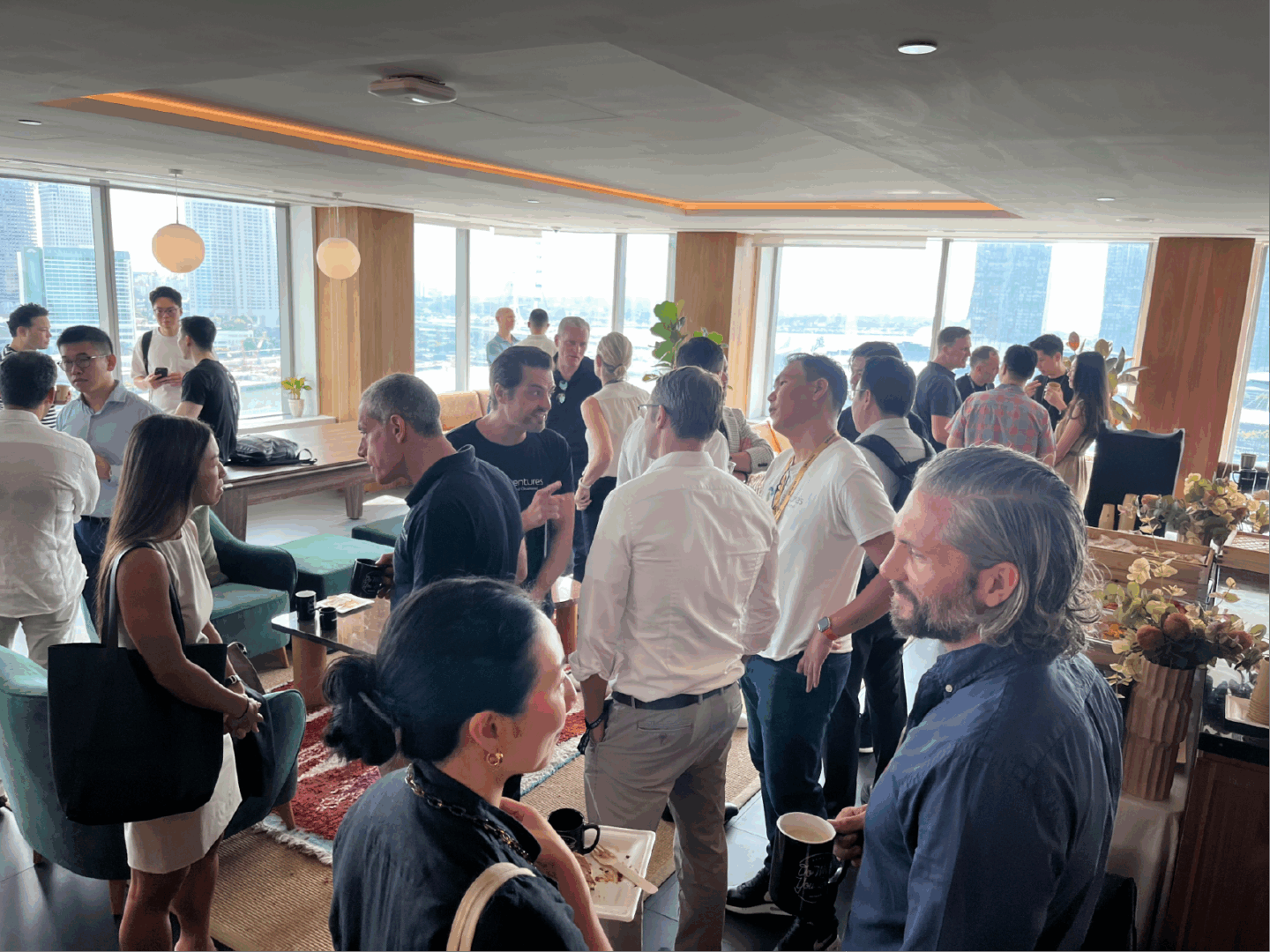

Ventures Lab by SC Ventures

A community for venture builders, investors & founders to connect, collaborate and co-create. Building impactful ventures takes more than great ideas — it takes a village of thinkers, doers, and risk-takers. Ventures Lab by SC Ventures is a community designed to bring together founders, investors, and venture builders to exchange knowledge, explore opportunities, and practice […]

Standard Chartered marks second edition of flagship Young Entrepreneur Programme with focus on AI and wellbeing

7 August 2025, Singapore – Standard Chartered (“the Bank”) has successfully concluded the second edition of its flagship Young Entrepreneur Programme (YEP) for the next generation of its high-net-worth (HNW) clients under the Priority Private segment. This year’s programme brought together 50 participants of 12 nationalities, a reflection of the Bank’s international network and diversity. […]

Zodia Markets raises $18.25 million in Series A fundraise

London, Monday 28th July 2025 – Zodia Markets, the digital asset platform enabling institutional capital through stablecoins, has raised $18.25 million in a Series A funding round, as demand for real-time wholesale trading, settlement and cross-border movement via stablecoins skyrockets. The raise was led by Pharsalus Capital, a New York head-quartered venture capital firm, with participation from […]

SC Ventures and Standard Chartered appoint Lisa Pollina as Vice Chairman, Americas

Singapore, July 17, 2025 – SC Ventures by Standard Chartered, which builds and invests in breakthrough ventures in and beyond banking, and Standard Chartered’s Corporate Investment Banking (CIB) division have appointed Lisa Pollina as Vice Chairman, Americas. Pollina will report to Alex Manson, CEO of SC Ventures, and matrix into Mandy DeFilippo, CEO for the […]

FPT and Standard Chartered-Backed audax Financial Technology Announce Strategic Partnership, Targeting 100M USD Revenue

Targeting USD 100M Revenue: FPT and audax Financial Technology aim to generate USD 100 million in revenue over the next three years, driving digital banking innovation across Asia Pacific and the Middle East. Strategic Regional Partnership: FPT becomes audax’s partner in Asia Pacific and the Middle East, providing expertise in cloud-native development, testing, and long-term […]

SC Ventures incubated Solv India acquired by Jumbotail

Singapore, June 30, 2025 – SC Ventures by Standard Chartered, which builds and invests in breakthrough ventures in and beyond banking, has completed the sale of its incubated venture, Solv India, to Jumbotail, one of India’s leading B2B marketplaces, post obtaining regulatory approval from Competition Commission of India. The combined business is now one of […]

SC Ventures to merge PointSource with Global Smart Climate Action Platform

FourTwoThree will leverage PointSource’s powerful data backbone to support small and medium businesses in their climate transition. Singapore, June 24, 2025 – PointSource, a platform that makes climate data usable, is now positioned to scale its impact far beyond what a single venture could achieve alone. PointSource will join forces with FourTwoThree, a smart action […]

SC Ventures partners with DIFC Innovation Hub to launch MENA’s First National Venture Building Programme

SC Ventures, Standard Chartered’s innovation, FinTech investment and ventures arm, has signed a strategic partnership with DIFC Innovation Hub to launch the National Venture Building Programme, a new initiative aimed at accelerating innovation and supporting venture creation across the region. As part of the collaboration, SC Ventures is providing its Venture Building as a Service […]

SC Ventures and Emirates NBD announce MoU to explore strategic innovation in MENA

SC Ventures, the innovation, fintech investment, and venture-building arm of Standard Chartered, has signed a Memorandum of Understanding (MoU) with Emirates NBD, a leading banking group in the Middle East, North Africa and Türkiye (MENAT) region, to explore strategic opportunities for collaboration. The collaboration outlines the intent of both parties to jointly explore innovation-led initiatives, […]

SC Ventures partners with A*STAR to leverage AI for smarter regulatory compliance

Singapore, April 23, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, has successfully completed two engagements under its Memorandum of Understanding (MoU) with a research institute under Singapore’s Agency for Science, Technology, and Research (A*STAR) — the A*STAR Institute of High Performance Computing (A*STAR IHPC). This collaboration advances the pursuit of […]

Jumbotail to acquire SC Ventures incubated Solv India

Bangalore, March 26, 2025 – SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, has agreed to the acquisition of its incubated venture, Solv India, by Jumbotail, one of India’s leading B2B marketplaces. The deal is subject to regulatory approvals. Jumbotail and Solv India combined will become a strong, multi-category B2B ecommerce platform […]

Dubai Eye 103.8: Supporting MENA’s vibrant tech and business innovation ecosystem

Gautam Jain explains our conviction to empower SMEs through our upcoming venture Project Hal; drive Financial Inclusion through myZoi and Furaha Financial; build the guardrails for a safe and sustainable Digital Assets ecosystem through Zodia Custody, Zodia Markets, Libeara and our $100 million Global Digital Asset Holdings fund; and support the Digital Economy through Appro.ae, […]

Meet Simran Grewal, SC Ventures UK and Recently Appointed Global Co-Lead for Standard Chartered’s Gender Colleague Community

We’re thrilled to share that Simran Grewal from SC Ventures UK has been appointed as Global Co-Lead for Standard Chartered’s Gender Colleague Community, driving continued support and meaningful progress towards gender equality across the bank and our community! In celebration of International Women’s Day this year, we sat down with Simran to find out what fuels her […]

Driving Innovation, Impact, and Growth across the Middle East

Globally, venture capital deal value inched upward last year, and in the Middle East we witnessed a dynamic shift with deal activity surging to an overall value of USD 1.5 billion. SC Ventures had a strong year: we expanded from 2 to 7 ventures across the Middle East, created over 150 jobs, closed more than […]

SC Ventures, Visa partner to support MENA region’s SME growth and innovation

Source: Economy Middle East Published: Mon 3 Mar 2025, 10:38 AM SC Ventures, Standard Chartered’s innovation, fintech investment and ventures arm, signed today a memorandum of understanding with Visa to develop solutions aimed at supporting small and medium-sized enterprises (SMEs) across the Middle East and North Africa (MENA) region. “This partnership represents a critical milestone in […]